The Institute for Supply Management (ISM) published a report on Tuesday indicating that manufacturing sector activity in the United States remained unchanged in September compared to the previous month. The ISM Manufacturing Purchasing Managers Index (PMI) stood at 48.5%, remaining below the 50% threshold for the sixth month. While a reading below 50 in a diffusion index generally indicates contraction, a Manufacturing PMI above 42.5% over time generally signals an expansion of the overall economy.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

https://www.youtube.com/watch?v=videoseries

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The New Orders Index remained in contraction territory, registering 46.1%, 1.5 percentage points higher than the 44.6% recorded in August. Meanwhile, the Production Index increased from 44.8% in August to 49.8% in September. ISM Chair Timothy Fiore states, “Demand remains subdued, as companies showed an unwillingness to invest in capital and inventory due to federal monetary policy — which the U.S. Federal Reserve addressed by the time of this report — and election uncertainty. Production execution stabilized in September. Suppliers have the capacity, with lead times improving and shortages reappearing.”

Of the 18 industries tracked by the ISM, the five manufacturing industries reporting growth in September are Petroleum & Coal Products; Food, Beverage & Tobacco Products; Textile Mills; Furniture & Related Products; and Miscellaneous Manufacturing. The 13 industries reporting contraction in September — in the following order — are Printing & Related Support Activities; Plastics & Rubber Products; Wood Products; Apparel, Leather & Allied Products; Primary Metals; Transportation Equipment; Nonmetallic Mineral Products; Electrical Equipment, Appliances & Components; Paper Products; Machinery; Chemical Products; Fabricated Metal Products; and Computer & Electronic Products.

Market Watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

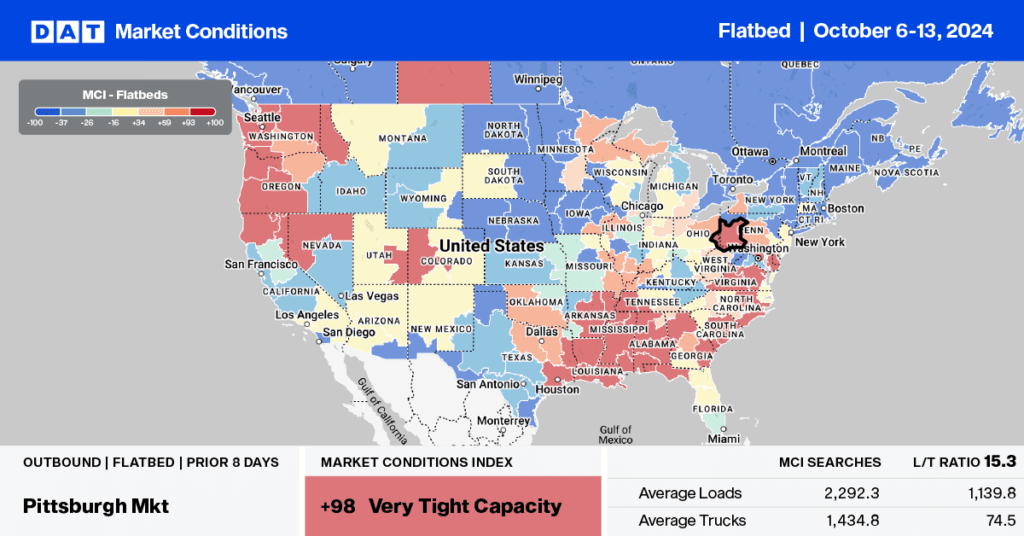

This week, we are concentrating on the inbound capacity in Southeastern freight markets, particularly in Georgia and Florida. Hurricane Milton made landfall in Florida, and the cleanup from Hurricane Helene has intensified, substantially impacting truckload capacity. Hurricane Milton has severely disrupted trucking in Florida, especially flatbed carriers involved in the building and construction industries, causing road closures, power outages, and flooding, particularly in areas like Tampa and Plant City.

Debris and fallen trees blocked key routes, complicating logistics and transport. Cranes toppled, and infrastructure damage hindered access to critical ports and highways. As recovery efforts continue, demand for flatbed services is expected to rise to support cleanup and rebuilding efforts, but the immediate impact has strained the supply chain and trucking capacity.

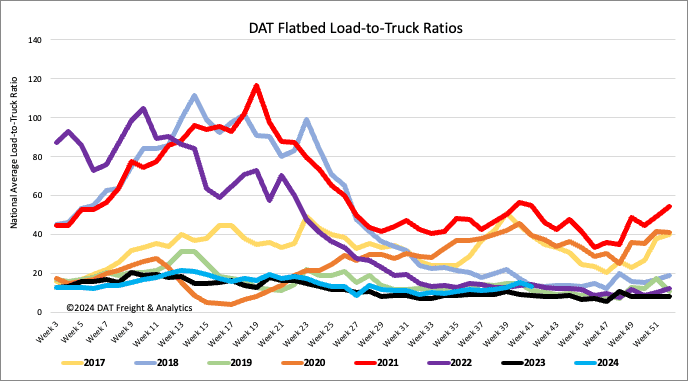

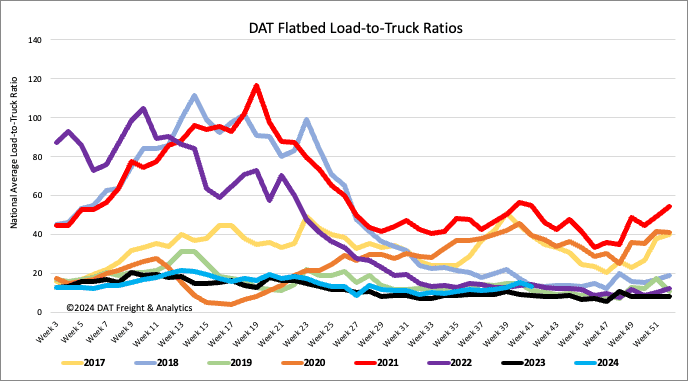

Load-to-Truck Ratio

Last week, the number of national flatbed load posts decreased by 5%, 27% higher than last year. Meanwhile, carriers’ equipment increased by 8% week-over-week. Consequently, the flatbed load-to-truck ratio decreased by 11%, reaching 13.54, 54% higher than last year’s LTR for Week 41.

Spot rates

Flatbed linehaul rates remained flat last week and have been around the $2.00/mile mark for almost two months. At just over $1.99/mile, the national average flatbed spot rate is $0.11/mile higher than last year and just $0.06/mile lower than in 2017, as the freight economy began improving.

Flatbed volumes nationally increased by 3% w/w and almost 18% w/w in the large Atlanta freight distribution hub. On the high-volume lane between Atlanta and Lakeland, where Hurricane Milton made landfall, volumes dropped 20% w/w, while capacity was extremely tight following last week’s $0.41/mile w/w increase in linehaul rates.

In Lakeland, outbound volumes plunged by 40% w/w, with rates dropping $0.14/mile to $1.46/mile. Lakeland’s inbound flatbed volumes dropped 31% w/w, while capacity was predictable tight during the peak of Hurricane Milton; inbound rates increased by $0.26/mile w/w to $2.54/mile.